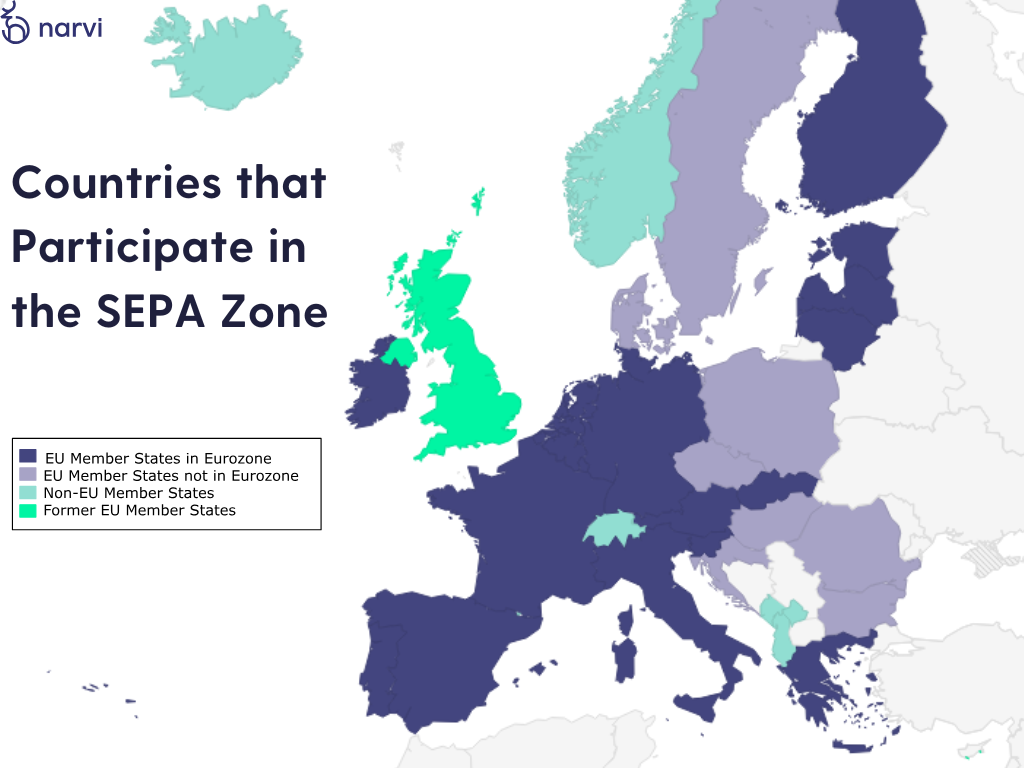

SEPA, a well-known name among Europeans and those with ties to Europe, stands for Single Euro Payments Area. SEPA money transfers are an initiative of the European Union countries and governments that simplify bank transfers denominated in EUR.

As of January 2025, SEPA has 36 member-states:

-

Austria, Belgium, Bulgaria, Cyprus, Croatia, Czech Republic (Czechia), Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Republic of Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovenia, Slovakia, Spain, and Sweden,

as well as the 3 EEA countries, which are part of the European Free Trade Association (EFTA):

-

Norway, Liechtenstein, and Iceland.

Additionally, these countries are included in the SEPA geographical scope:

-

Switzerland, Monaco, the United Kingdom, Montenegro, Albania, Andorra, San Marino, and Vatican City.

Territories That Are Part of SEPA

- Åland Islands (Finland) - Included in SEPA, as they are part of Finland, an EU member state and SEPA participant.

- Canary Islands (Spain) - Included in SEPA, as they are part of Spain.

- Azores and Madeira (Portugal) - Included in SEPA, as they are part of Portugal.

- French Overseas Departments and Territories (e.g., Guadeloupe, Martinique, Réunion, French Guiana, Mayotte) - Included in SEPA, as they are integral parts of France.

- Gibraltar (UK) - Included in SEPA, even after Brexit, due to agreements for financial cooperation.

- Channel Islands (Jersey, Guernsey) and Isle of Man, the British Crown Dependencies, were included within the geographical scope of the SEPA Schemes with effect from 1 May 2016.

- Saint-Pierre and Miquelon (France) - As resolved by the EPC Plenary between March 2006 and December 2013, the French collectivities of Mayotte and Saint-Pierre-et-Miquelon had become part of the geographical scope of the SEPA Schemes.

Territories That Are Not Part of SEPA

- Faroe Islands (Denmark) - Not included in SEPA; the Faroe Islands have their own currency, the Faroese króna.

- Greenland (Denmark) - Not included in SEPA; Greenland has its own financial systems and does not use the euro.

- French Overseas Collectivities (or COM; New Caledonia, French Polynesia, Wallis, and Futuna) - Not included in SEPA as they are not part of the EU or euro area.

SEPA Countries List and IBAN/BIC code

EUR SEPA Countries and Territories

This is a list of SEPA zone countries that use the Euro as their main currency. In EUR countries, all bank accounts that were previously reachable through a national scheme are now reachable via the SEPA payment schemes.

The Europe-wide standardised procedures for cashless payment transactions can be used in all of these countries.

Country |

IBAN/BIC code |

|

Åland Islands (part of Finland) |

FI |

|

Andorra |

AD |

|

Austria |

AT |

|

Azores (part of Portugal) |

PT |

|

Belgium |

BE |

|

Canary Islands (part of Spain) |

ES |

|

Croatia |

HR |

|

Cyprus |

CY |

|

Estonia |

EE |

|

Finland |

FI |

|

France |

FR |

|

Germany |

DE |

|

Greece |

GR |

|

Ireland |

IE |

|

Italy |

IT |

|

Latvia |

LV |

|

Lithuania |

LT |

|

Luxembourg |

LU |

|

Madeira (part of Portugal) |

PT |

|

Malta |

MT |

|

Monaco |

MC |

|

Netherlands |

NL |

|

Portugal |

PT |

|

San Marino |

SM |

|

Slovakia |

SK |

|

Slovenia |

SI |

|

Spain |

ES |

|

Vatican City State |

VA |

SEPA Countries Where Local Currency is Not EUR

Currency code where the local currency differs from the Euro. Also, in non-EURO countries, most importers have Euro bank accounts and can thus transfer money over SEPA for free.

In non-eurozone countries, the SEPA schemes are only used for euro-denominated payments. Reachability is only required for euro-denominated bank accounts. For payments made in the local currency, national schemes should continue to be used.

Country |

IBAN/BIC code |

Currency code |

|

Bulgaria |

BG |

BGN |

|

Czech Republic |

CZ |

CZK |

|

Denmark |

DK |

DKK |

|

Gibraltar |

GI |

GIP |

|

Hungary |

HU |

HUF |

|

Iceland |

IS |

ISK |

|

Liechtenstein |

LI |

CHF |

|

Norway |

NO |

NOK |

|

Poland |

PL |

PLN |

|

Romania |

RO |

RON |

|

Sweden |

SE |

SEK |

|

Switzerland |

CH |

CHF |

|

UK |

GB |

GBP

|

-

Liechtenstein and Switzerland are non-EU countries that participate in SEPA for euro-denominated payments but also use their local currencies (CHF).

-

Gibraltar is part of the UK SEPA area, even though it uses the Gibraltar pound (linked to GBP).

-

The UK remains part of SEPA for euro payments despite no longer being part of the EU.

Understanding SEPA Exclusions: Countries Outside the Zone and Their Implications

While SEPA encompasses much of Europe, there are notable exceptions, such as the Danish territories of the Faroe Islands and Greenland, which are not included. Similarly, despite adopting the euro as their national currency, Kosovo and Montenegro remain outside the SEPA zone. Neither is Bosnia and Herzegovina in SEPA (the official currency is Bosnia and Herzegovina Convertible Mark (BAM). This makes it essential for businesses and consumers to stay informed about which countries fall outside SEPA, as they may be subject to varying regulations.

Additionally, some countries use the IBAN system but are not SEPA members, including Albania, Belarus, Brazil, Saudi Arabia, Turkey, Ukraine, and the United Arab Emirates.

Jurisdictional Scope of SEPA Schemes

The Single Euro Payments Area (SEPA) is a collaborative framework designed to streamline euro payments across participating countries and territories. It extends beyond the European Union, encompassing non-EU countries, territories, and even some areas where the euro is not the local currency.

1. EU/EEA Member States (Euro and Non-Euro)

These countries are full participants in the SEPA scheme.

-

Austria

-

Belgium

-

Bulgaria

-

Croatia

-

Cyprus

-

Czech Republic

-

Denmark

-

Estonia

-

Finland

-

France

-

Germany

-

Greece

-

Hungary

-

Iceland

-

Ireland

-

Italy

-

Latvia

-

Lithuania

-

Luxembourg

-

Malta

-

Netherlands

-

Poland

-

Portugal

-

Romania

-

Slovakia

-

Slovenia

-

Spain

-

Sweden

2. Non-EU SEPA Countries (Independent Countries Outside the EU/EEA)

These countries are outside the EU but are still part of SEPA for euro-denominated payments.

-

Andorra

-

Liechtenstein

-

Monaco

-

San Marino

-

Switzerland

3. Territories and Regions Linked to the EU

These are territories that are not independent countries but are part of the SEPA scheme due to their relationship with EU countries.

-

Åland Islands (Finland)

-

Canary Islands (Spain)

-

Azores (Portugal)

-

Madeira (Portugal)

-

Gibraltar (UK)

-

Guernsey (UK)

-

Isle of Man (UK)

-

Jersey (UK)

-

Saint-Pierre-et-Miquelon (France)

-

Mayotte (France)

-

Vatican City State (Italy)

4. UK and Overseas Territories

The UK, while no longer part of the EU, remains part of SEPA for euro-denominated payments due to bilateral agreements.

-

United Kingdom (GB)

-

Gibraltar (as a British overseas territory)

Note that the Channel Islands (Jersey, Guernsey) and Isle of Man were never part of SEPA despite being Crown Dependencies of the UK. The Channel Islands and Isle of Man are Crown Dependencies, which means they are not part of the UK, EU, or EEA, nor do they have any special agreements that align them with SEPA. They are outside the EU regulatory framework, including financial regulations governing SEPA.

National SEPA Authorities

Each participating region authorizes and regulates payment service providers (PSPs) to ensure adherence to SEPA scheme rules. The European Payments Council (EPC) maintains an updated list of these authorities, which includes non-European Economic Area (EEA) SEPA members.

Why This Scope Matters

Understanding the jurisdictional scope of SEPA is critical for businesses and individuals. It clarifies:

-

Where SEPA payment schemes apply.

-

The types of euro transactions covered under SEPA frameworks.

-

Regulatory differences in non-EEA regions participating in SEPA.

For more details and the latest updates, refer to the EPC’s official SEPA scheme countries document.

Brexit's Impact on Financial Transactions Between the UK and EU

The Brexit Effect on SEPA Transactions

While the UK left the European Union on January 1, 2021, it remains a part of the SEPA payment system. This means UK-based banks and payment service providers can still process SEPA transactions. However, Brexit introduced a few challenges:

- Additional Fees: Some EU banks now treat SEPA transactions with UK banks as cross-border payments, incurring extra charges.

- KYC and AML Compliance: UK businesses face stricter scrutiny due to non-EU regulatory alignment.

- Currency Exchange Implications: Cashless payments between the EU and the UK often involve currency conversions, adding complexity.

- IBAN Discrimination: Certain EU businesses may refuse UK IBANs, despite SEPA rules prohibiting discrimination based on IBAN origin.

Takeaway: Businesses operating across the UK-EU divide should double-check fees, regulations, and compliance requirements to avoid delays and unexpected costs.

Why should I open a SEPA account in Europe?

Opening a European SEPA account is particularly beneficial for those who frequently travel to or do business in SEPA member countries. Whether you are an individual or a business, having a SEPA account can streamline transactions and offer a range of advantages. An IBAN account allows you to:

-

Save on fees: With SEPA, you can make cheaper cash withdrawals when traveling across the SEPA region and avoid unnecessary transaction charges.

-

Enjoy fast, standardized payments: Transactions in euros are swift and consistent, simplifying business operations and personal transfers.

-

Convenience in the eurozone: You can easily use your European debit, credit, or payment card to make purchases, whether you’re shopping or paying for services across the euro area.

-

Efficient banking: Most European financial institutions offer seamless mobile banking and online banking services, which are not only convenient but also user-friendly.

In many European Economic Area (EEA) countries, which have become increasingly cashless, having a European payment account and card can save you time and money. It ensures that your payments and transfers are both cost-effective and simple, allowing you to manage business and personal finances more easily across multiple countries within the SEPA system.

How to get a European SEPA?

For businesses operating within Europe, exporters with clients based in Europe can open a virtual bank account with Narvi Payments and take advantage of the benefits offered by SEPA regulations.

One of the advantages of SEPA is that the amount of money you send arrives unchanged in the bank account of the recipient because the charges on such transfers are tightly regulated. According to the decision of the European Parliament, the fees applied to cross-border transfers in the eurozone’s common currency, the Euro, between SEPA member countries cannot be higher than the charges applied to equivalent domestic transfers (for amounts up to 50.000 EUR).

It also means it’s mostly enough to have one bank account in Europe to conveniently do business in other states. If you decide to use our services, Narvi will take care of lowering the cost of your banking, making it cheaper than a normal bank transfer.

How do I get an IBAN account?

The virtual bank account offered by Narvi is an International Bank Account Number (IBAN), enabling you to make international transfers. Narvi provides the technology and payment API to enable B2B transactions, making them faster and more cost-effective than before.

SEPA, as an agreement, is designed to encourage activity among European countries, keeping things simpler for exporters, importers, and others in business, as well as the customers. An instant SEPA bank transfer is cost-effective and takes no more than an hour or two (on a working day) between the majority of financial institutions within the system.

A SEPA transfer is also accessible for companies outside of Europe

Through a digital bank, you can receive your own virtual bank account within the SEPA region, enabling seamless international transfers. For example, Narvi provides this service to companies in the European Union, the European Economic Area, and many other countries worldwide. Almost all companies incorporated within the EU/EEA can be easily onboarded, and some companies incorporated outside the EU/EEA may also be eligible.

SEPA credit transfer vs direct debit - what’s the difference?

A SEPA credit transfer is done in euros. It is a simple one-time transfer of funds between banks with IBAN identification codes. If the transfer was scheduled before the cutoff time on a working day, the recipient will receive it on the same day. SEPA credit transfers are used by customers as one-time payments for goods or services.

Differences Between SEPA Credit and SEPA Instant Payments

Here’s a comparison table outlining the differences between SEPA Credit Transfers (SCT) and SEPA Instant Transfers (SCT Inst), tailored for tech-savvy users:

Feature |

SEPA Credit Transfer (SCT) |

SEPA Instant (SCT Inst) |

|---|---|---|

|

Processing Time |

Typically, one business day (up to 2 days max) |

10 seconds or less |

|

Availability |

Business hours only |

24/7/365 |

|

Transaction Limit |

No specific limit |

€15,000 per transaction (in most cases) |

|

Coverage |

All SEPA member states |

Not all banks currently support SCT Inst |

|

Fees |

Lower, may vary between banks |

Slightly higher due to real-time processing |

|

Use Case |

Non-urgent payments |

Urgent, real-time transactions |

Why It Matters: SCT Inst is ideal for tech-savvy businesses and individuals requiring instant euro payments, particularly in e-commerce, gig economy payouts, and emergency fund transfers.

Detailed Breakdown of SEPA Payment Methods

Here’s a breakdown of SEPA’s four main payment methods:

SEPA Credit Transfer (SCT)

-

Purpose: Non-urgent payments in euros across SEPA countries.

-

Processing Time: Typically within one business day.

-

Users: Individuals and businesses.

-

Key Features:

-

Transparent fees.

-

Standardized payment format.

-

SEPA Instant Transfer (SCT Inst)

-

Purpose: Real-time euro payments.

-

Processing Time: Under 10 seconds.

-

Users: Individuals and businesses needing urgent transfers.

-

Key Features:

-

Available 24/7/365.

-

Transaction limit: €15,000 (varies by bank).

-

SEPA Direct Debit Core (SDD Core)

-

Purpose: Preauthorized euro payments initiated by payees.

-

Processing Time: Varies based on payment schedules.

-

Users: Individuals.

-

Key Features:

-

Refund rights for 8 weeks after payment.

-

SEPA Direct Debit B2B (SDD B2B)

-

Purpose: Preauthorized euro payments for business transactions.

-

Processing Time: Varies based on payment schedules.

-

Users: Businesses only.

-

Key Features:

-

No refund rights once authorized.

-

The debtor must explicitly approve each mandate.

-

Source for Statistics and Further Details: ECB Statistical Data Warehouse

What are the other advantages of SEPA payments?

How much time does it take for my payment to settle? Most SEPA payments are settled the next day.

As of November 2017, banks have been implementing Instant SEPA, which will settle payments of up to 15.000 EUR within 10 seconds.

The €15,000 limit for SEPA Instant Payments will increase to €100,000 starting in 2025 due to the Instant Payment Regulations (IPR).

SEPA: cheap, easy, and fast

SEPA is set up in a way that makes banking seamless and quick internationally. Bank transfers can even happen without a fee, as banks are only allowed to charge the same amount for SEPA payments as for their equivalents in local currencies; if there is a fee waiver on domestic transfers in euros, there must be one for international ones.

SEPA enables businesses and customers to use cross-border bank transfers without the hassle and fees associated with conventional banking. For exporters who want to access SEPA, a bank account in one of the member countries is required. While it might be difficult to open an IBAN account in Europe without being formally registered in one of the member countries, we have found a solution: with a virtual bank account, you can benefit from the initiative.

SEPA debit transfer

Unlike SEPA credit transfer, which is a simple one-time payment, SEPA debit transfer is a recurring payment across borders within the EU. There are two types of these payments, and their usage differs. The first one is designed for the customers paying for products, services, and goods, and all banks in SEPA countries are obliged to participate in this scheme. The second one was devised for industry and businesses and is not mandatory for all the banks inside SEPA agreements.

In order to set up a SEPA debit transfer, the customer supplies a signed authorization to the payee, along with information about the bank account that will be charged: name of the owner of the account, account number, IBAN, and BIC. The merchant or payee has to retain proof (a mandate) that the customer has authorized the recurring payment. Mandates can be either electronic or in paper form.

-

SEPA debit transfers can be set up on a recurring basis for a certain number of times or an indefinite number of times until canceled. SEPA debit transfers can be set up between consumers and businesses, for example, to pay monthly rent, facilities, a recurring loan payment, or other services, say, housecleaning, electricity, or internet access. The transfer will be done automatically on a predetermined date.

-

SEPA debit transfers can also be set up between two businesses to pay recurring fees. For example, a business may subcontract another business to provide security for a recurring regular fee that can be paid via SEPA debit. In this case, both the creditor and the debtor have to submit mandates to the bank.

SEPA points to a single currency system, yet in reality, many of the countries participating in the system did not adopt the common currency. The agreements at the core of the system have encouraged financial institutions in all 36 SEPA member countries to offer Euro bank accounts to their customers so they can also benefit from it. There are exceptions: Akrotiri and Dhekelia, French Southern and Antarctic Lands, Kosovo, and Montenegro are the countries that use the euro as a currency and are not part of the SEPA.

BIC code differs from an IBAN code

French overseas territories have a different BIC code. Their IBAN bank account numbers start with FR. Note that not all of these territories participate in SEPA (e.g., Saint Pierre and Miquelon and Saint Barthélemy don't) even though they use French IBANs.

Territory |

BIC code |

IBAN code |

|---|---|---|

|

French Guiana |

GF |

FR |

|

Guadeloupe |

GP |

FR |

|

Martinique |

MQ |

FR |

|

Mayotte |

YT |

FR |

|

Réunion |

RE |

FR |

|

Saint Barthélemy |

BL |

FR |

|

Saint Martin (French part) |

MF |

FR |

|

Saint Pierre and Miquelon |

PM |

FR |

When did SEPA start?

Credit transfers became available across Europe in January 2008. Direct debits and debit cards were made possible at the end of 2010. It has led to more competition and cheaper, more efficient cross-border Euro payment transfers.

Some of the newest members of the SEPA team are Andorra and Vatican, which joined the agreement in 2019.

Timeline of SEPA Developments

Year |

Milestone |

|---|---|

|

2002 |

SEPA initiative launched by the European Commission to unify euro payment markets. |

|

2008 |

SEPA Credit Transfers (SCT) were introduced, enabling euro transfers across SEPA countries. |

|

2009 |

SEPA Direct Debit (SDD) launched for euro direct debit transactions. |

|

2010 |

National payment infrastructures are required to align with SEPA standards. |

|

2014 |

SEPA is fully operational in all Eurozone countries; banks are mandated to support SEPA payments. |

|

2016 |

BIC codes are no longer required for SEPA transactions; IBANs are sufficient for payments. |

|

2017 |

Launch of SEPA Instant Payments (SCT Inst), enabling 10-second euro transfers. |

|

2019 |

Andorra and Vatican City joined SEPA, expanding membership to 36 countries. |

|

2021 |

UK maintained SEPA membership post-Brexit, continuing participation in the SEPA instant credit transfer scheme. |

|

2024 |

Instant Payment Regulations (IPR) are enacted, mandating instant payment support by January 2025. |

|

2025 |

Banks must enable instant payment reception by January 9 and sending by October 9. |

Why It Matters: This timeline highlights SEPA’s evolution and its increasing focus on speed, efficiency, and inclusion.

An Introduction to SEPA by the EPC

The European Payments Council produced this extended video of almost 8 minutes about SEPA.

European Payment Council

SEPA credit and debit transfers were established by the European Payment Council as a way to improve international payment processing and impose standards within SEPA and its 36 different countries. In order to use SEPA credit and debit transfers, service providers have to be formal participants in the SEPA scheme.

Glossary of Key Terms Related to SEPA

A glossary will enhance clarity for readers unfamiliar with SEPA-specific jargon. Here are key terms to include:

-

IBAN (International Bank Account Number): A standardized international system for identifying bank accounts, ensuring smooth cross-border payments.

-

BIC (Bank Identifier Code): Also known as SWIFT code, it uniquely identifies a bank involved in a transaction.

-

SEPA Credit Transfer (SCT): A payment scheme for non-urgent credit transfers in euros across SEPA countries.

-

SEPA Instant Transfer (SCT Inst): Enables real-time euro payments within 10 seconds, available 24/7.

-

SEPA Direct Debit (SDD): A payment scheme allowing preauthorized debits in euros, initiated by the payee.

-

SDD Core: Designed for individual customers.

-

SDD B2B: Tailored for business-to-business transactions, requiring explicit debtor authorization.

-

-

PSD2 (Payment Services Directive 2): An EU regulation aimed at creating a safer, more open payments ecosystem across Europe.

Further reading about a SEPA Transfer

-

European Payments Council: List of SEPA Scheme Countries - v5.0, 21 Nov 24.

-

Detailed information regarding SEPA can be found on the official EU website.

Frequently Asked Questions about SEPA

Which countries are registered with SEPA?

SEPA encompasses all EU member states, EEA countries (Iceland, Liechtenstein, Norway), as well as non-EEA countries such as the United Kingdom, Switzerland, Monaco, Andorra, San Marino, and Vatican City. It also includes territories like Guernsey, Jersey, and the Isle of Man. Since Brexit, the UK remains a participant in SEPA but is now considered a non-EEA country, similar to other non-EU SEPA participants.

Has the UK remained a SEPA country after Brexit?

Is the UK still in SEPA?

What is the purpose of SEPA payments?

What is SEPA in the USA?

Is SEPA the same as ACH?

No, SEPA and ACH are different. SEPA is a European payment network for euro transactions, while ACH is a US network for domestic and international transactions, primarily in USD.

How can I calculate or check an IBAN for SEPA transactions?

To ensure accurate SEPA transactions, you can calculate or verify an IBAN using trusted online tools. Simply input the bank name and account number into a reliable IBAN calculator.

Which banks support SEPA?

Most banks in SEPA-member countries support SEPA payments. Customers should check directly with their bank to confirm participation.

Can I transfer USD with SEPA?

No, SEPA exclusively supports euro-denominated transactions. Other systems, like SWIFT or ACH, are used for USD transfer.

How does a SEPA payment work?

SEPA payments use standardized details like IBAN and BIC for euro transactions. Standard SEPA credit transfers typically settle within one business day, while Instant SEPA payments settle in under 10 seconds. providing a cost-effective solution for cross-border transactions in euros.

Who are the members of the SEPA zone 2025?

SEPA members include 27 EU countries, 3 EEA nations, 8 non-EEA countries (including the UK), and territories such as Guernsey, Jersey, and Isle of Man. Check this page for a detailed list of SEPA members.

Is the UK still in the Eurozone?

No, the UK has never been part of the eurozone, as it retained the British pound. However, it remains part of SEPA for euro transactions.

Can you do a SEPA transfer with the UK?

Yes, SEPA transfers to and from the UK are supported, ensuring seamless euro transactions.

Which countries are non-SEPA?

Non-SEPA countries are those outside Europe or those not included in the SEPA geographical scope and include (but not limited to) the following:

-

Canada

-

China

-

Australia

-

India

-

Japan

-

Brazil

-

Russia

-

South Africa

-

Greenland

-

United States

What are the benefits of SEPA?

Benefits of SEPA include:

-

Faster and cheaper cross-border euro payments.

-

Standardized processes across participating countries.

-

Simplified Euro account management.

-

Enhanced financial integration across Europe

What are the goals of SEPA?

SEPA aims to:

-

Harmonize cross-border euro payments.

-

Reduce transaction costs.

-

Improve financial integration in Europe.

-

Boost economic cooperation across member countries

Originally published December 7, 2015. Updated January 25, 2025.

Disclaimer

B2Bpay.co does not provide tax, investment, legal or accounting advice. The material on this page has been prepared for informational purposes only. It should not be relied on for financial or legal advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Page content

About the author

Disclaimer

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from B2B Trade Payment Services AB or its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

How to open a bank account in Europe

We have comprehensive guides on opening bank accounts across multiple European countries. These resources also explain how a virtual bank account with Narvi Payments can be a smarter alternative for international transfers, offering better exchange rates and greater convenience.

-

How to open a bank account in Andorra

How to open a bank account in Andorra -

How to open a bank account in Austria

How to open a bank account in Austria -

How to open a bank account in Bulgaria

How to open a bank account in Bulgaria -

How to open a bank account in Croatia

How to open a bank account in Croatia -

How to open a bank account in Czech Republic

How to open a bank account in Czech Republic -

How to open a bank account in Cyprus

How to open a bank account in Cyprus -

How to open a bank account in Denmark

How to open a bank account in Denmark -

How to open a bank account in Estonia

How to open a bank account in Estonia -

How to open a bank account in Finland

How to open a bank account in Finland -

How to open a bank account in France

How to open a bank account in France -

How to open a bank account in Germany

How to open a bank account in Germany -

How to open a bank account in Greece

How to open a bank account in Greece -

How to open a bank account in Hungary

How to open a bank account in Hungary -

How to open a bank account in Ireland

How to open a bank account in Ireland -

How to open a bank account in Italy

How to open a bank account in Italy -

How to open a bank account in Latvia

How to open a bank account in Latvia -

How to open a bank account in Liechtenstein

How to open a bank account in Liechtenstein

-

How to open a bank account in Lithuania

How to open a bank account in Lithuania -

How to open a bank account in Luxembourg

How to open a bank account in Luxembourg -

How to open a bank account in Malta

How to open a bank account in Malta -

How to open a bank account in Monaco

How to open a bank account in Monaco -

How to open a bank account in the Netherlands

How to open a bank account in the Netherlands -

How to open a bank account in Norway

How to open a bank account in Norway -

How to open a bank account in Poland

How to open a bank account in Poland -

How to open a bank account in Portugal

How to open a bank account in Portugal -

How to open a bank account in Romania

How to open a bank account in Romania -

How to open a bank account in San Marino

How to open a bank account in San Marino -

How to open a bank account in Slovakia

How to open a bank account in Slovakia -

How to open a bank account in Slovenia

How to open a bank account in Slovenia -

How to open a bank account in Spain

How to open a bank account in Spain -

How to open a bank account in Sweden

How to open a bank account in Sweden -

How to open a bank account in Switzerland

How to open a bank account in Switzerland -

How to open a bank account in the UK

How to open a bank account in the UK