Can you trust Fintech Companies?

Fintech started as a small innovation and turned into a buzzword and an important movement that reshaped the way we do and think money. Since 2014, when the fintech scene picked up speed and started challenging the financial systems - byzantine, expensive, slow, opaque - they have come a long way. The battle for trust of the customers is slowly progressing, thanks to ingenuity of new solutions and hard work at proving the safety and viability of these services, despite scandals which scarr the reputation, such as this year’s Wirecard story. Fintech companies have a lot at stake, and they do take increasingly good care of most critical issues.

Most challenges revolve around privacy and lack of regulations and oversight that would go hand in hand with break-neck innovation. Until that is solved, one way to gauge if a fintech company is a reliable choice would be to look at the partnering institutions - the presence of older, established banks, regulated by national and international laws, is a reliable sign of security. In the case of B2B Pay, trust is built thanks to Barclays, Nordea Bank, HSBC, CIMB and Standard Chartered, with whom we cooperate. We’ve also been one of the first players on the fin tech market, trailblazing the way for other companies and coming up with innovative, more accessible services for companies from outside of Europe who want to access the European partners and clients.

Can fintech as a service (FaaS) make your company better?

To adapt a business to a new set of rules without significant downtime is hard. It requires knowledge of the new subject which is often frightening and feels like a risk not worth taking. This subject is especially true in banking. When we look at glass laden buildings with a crafted branding strategy we are empowered and they seem infallible. What changed in the 21st century goes beyond this perception: it is security through clarity that empowers companies to thrive.

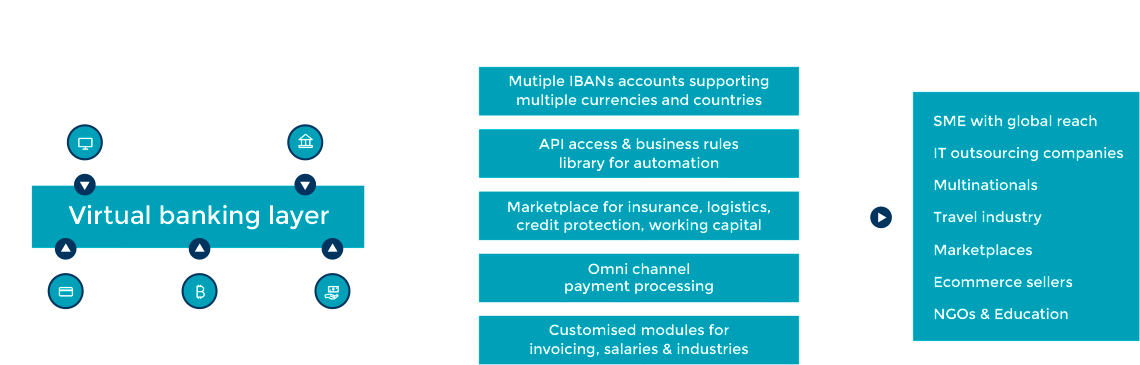

In the past years, virtual banking - powered by the FinTech industry - has become the stepping stone for international businesses that expect a higher level of efficiency, possible because of the automation of essential banking routines. With an average European bank providing 800 different products, it is no wonder that things got out of hand, and understandably so. To the rescue come innovators such as B2B Pay, taking it one problem at a time, with one goal in mind: automation perfection. With this, we commit to creating the ultimate virtual banking experience for businesses, via innovations that cut costs and drive our clients forward.

The changes we introduce into the financial ecosystem make for more optimised end to end processes for our clients and a more fluent execution of commercial services, following the expertise and standards of traditional banks, with whom we partner.

The advantages of a corporate virtual banking layer

Once contested, now the correlation between early adoption of FinTech solutions and increased efficiency is now clear. Accenture reports that companies can reduce operational costs by as much as 50% with the use of our solutions. FinTech as a Service bridges the gap between companies' hesitancy to work with new technology. Thanks to us, it is now possible to implement new systems with minimal downtime, allowing for innovative solutions and cost reducing changes to happen faster, with lower risk.

At the same time, by calibrating our core virtual banking offer - virtual IBANs - with real needs of our customers, FinTechs facilitates the growth of various industries. The more commonplace the adoption, the more empowered the industry as a whole.

Why having virtual IBANs is fundamental in today's world

When a company struggles getting paid, everybody loses. Money and time is wasted while, thanks to the persistent application of old technology - banks are obliged to charge a fortune for services that should be, by now, When a company struggles with getting paid, everybody loses. Money and time are wasted while, thanks to the persistent application of old technology, banks are obliged to charge a fortune for services that should be, by now, quantifiably cheaper. In our experience, traditional banks can keep up to 20% of a company's profit margin in international B2B transfer fees. Imagine: 20% of your margin, just for getting paid.

Fortunately, the emergence of the fintech ecosystem is making things easier for you. Until recently, it was still either impossible, or very difficult, for a small or medium company to have a European bank account, which meant that bank transfers took a long time, and that the fees and charges on these transactions were sometimes extravagantly high.

Nowadays, FaaS provides a functional roadmap to how a corporation can use this new financial technology. It gives you concrete ways to introduce new solutions slowly into the organisation. It maps out the benefits and helps estimate which of our services will be most optimal and helpful for the type of business you conduct.

This adaptation can happen in 2 ways: as a large company you may opt for what is de-facto your own white label bank by gaining access to our virtual banking API. With this, you can create business rules, connect treasury, accounting and auditing, and offer any digital product to your customers (such as insurance, factoring, so on). If you need this, let us know.

As an SME, the best virtual bank you can find is right here. We are the one-stop shop for virtual banking needs: a virtual bank account, invoicing, working capital, credit protection, shipping insurance, logistics and payments integration, all in one place.

This results in higher agility and savings

As already mentioned, compared to the financial landscape back in 2016, when B2B Pay has started, fintech has grown from a position of an underdog to an increasingly viable choice for many businesses and private clients. Nowadays, B2B Pay is particularly well-fit to serve organisations such as NGOs, governmental agencies, exporter and importers, travel agencies, and many more.

Thanks to our solutions, companies of all sizes can save up to 80% on transaction fees, virtually eliminate reconciliation issues and significantly speed up receiving payments. In certain situations, for example when sending money to India, a company is able to receive money in a few hours, instead of a few weeks.

In their avoidance of new technology, big and small companies are losing huge portions of their profits. With FinTech as a Service (FaaS), SMEs can cut down on international B2B transfer fees and costs related to conversions. Even corporations stand to win here - these tweaks give them an advantage over competitors.

Take the example of a bluechip insurance corporation that recently approached us requesting API access to 10.000 virtual IBANs. We were able to enable their business instantly.

How is the booming E-commerce benefiting from FaaS?

2020 has seen an incredible boost of both fintech solutions and e-commerce - as their interdependence increased, it simultaneously fueled each other’s rise and ingenuity. Etsy would be a perfect example of a once overlooked marketplace for handicrafts that turned into a Wall Street darling this year, and its smart and courageous adoption of fintech as a service solution was no small part of that success. Its expansion from a US-oriented market into a global player, with partners in many European countries, was possible precisely because of adoption of novel financial tools and collaboration with fintech companies. They enrolled dozens of 35.000 new sellers, boosted its value and grew its customer base in Europe and the US (now there’s 9 million of them in the US alone). All that thanks to agility, safety and speed of solutions like ours.

Without B2B Pay, your company:

- Cannot/ will find it difficult and expensive to open a bank account in Europe

- Cannot easily/cheaply collect or send domestic wire transfers between SEPA countries

- Pays steep SWIFT fees for transfers

- Pays currency conversion fee of 2-6%

- Cannot access local payment gateways

- Experiences the frustration of bureaucratic banking processes

- Cannot, or find it less accessible to collect payments from marketplaces like Amazon

- Money transfers can take up to 5 days

With B2B Pay, your company:

- Receives SEPA payments from 36 EU countries for free within 2-12 hours

- Sends SEPA payments to 36 member countries

- Saves 30 Euro SWIFT charges and +80% on FX

- Takes advantage of FX conversion automation

- Uses IBAN to integrate with marketplaces and payment gateways

- Accesses premium brokers to make global payments in 150+ currencies

- Gets Instant notifications of incoming payments

- Takes advantage of easy online onboarding