B2B Pay is not offering financial advice around banking or insurances, and doesn't have immediate plans to offer financial advice.

New EU banking rules (PSD2) will bring about a renaissance in decisions about all the nitty-gritty routines which normal business owners struggle with. Small- and medium-sized enterprises (SMEs) are likely to benefit the most. They will be able to make smarter, automated decisions on everything ranging from international payments to loans and insurance.

Financial decisions are hard for SMEs

Many small to medium size businesses struggle with financial decisions such as:

- I have suppliers in Brazil, how do I pay them? Am I paying too much?

- How do I pay the new freelancer in Ukraine? Am I paying them in the best way possible?

- I need short term loans. How do I get them and what's a fair interest rate?

- What's the best way to pay employees?

- I have bank accounts in 5 countries, staff in 3, suppliers in 10. How can I manage?

- I am drowning in fees, how can I save on some?

- I don't know how to structure my loans!

All these are questions that can be answered with a lot of research online or spending a lot of money on specialist advisers. But with PSD2, these problems are going to change.

Enter PSD2

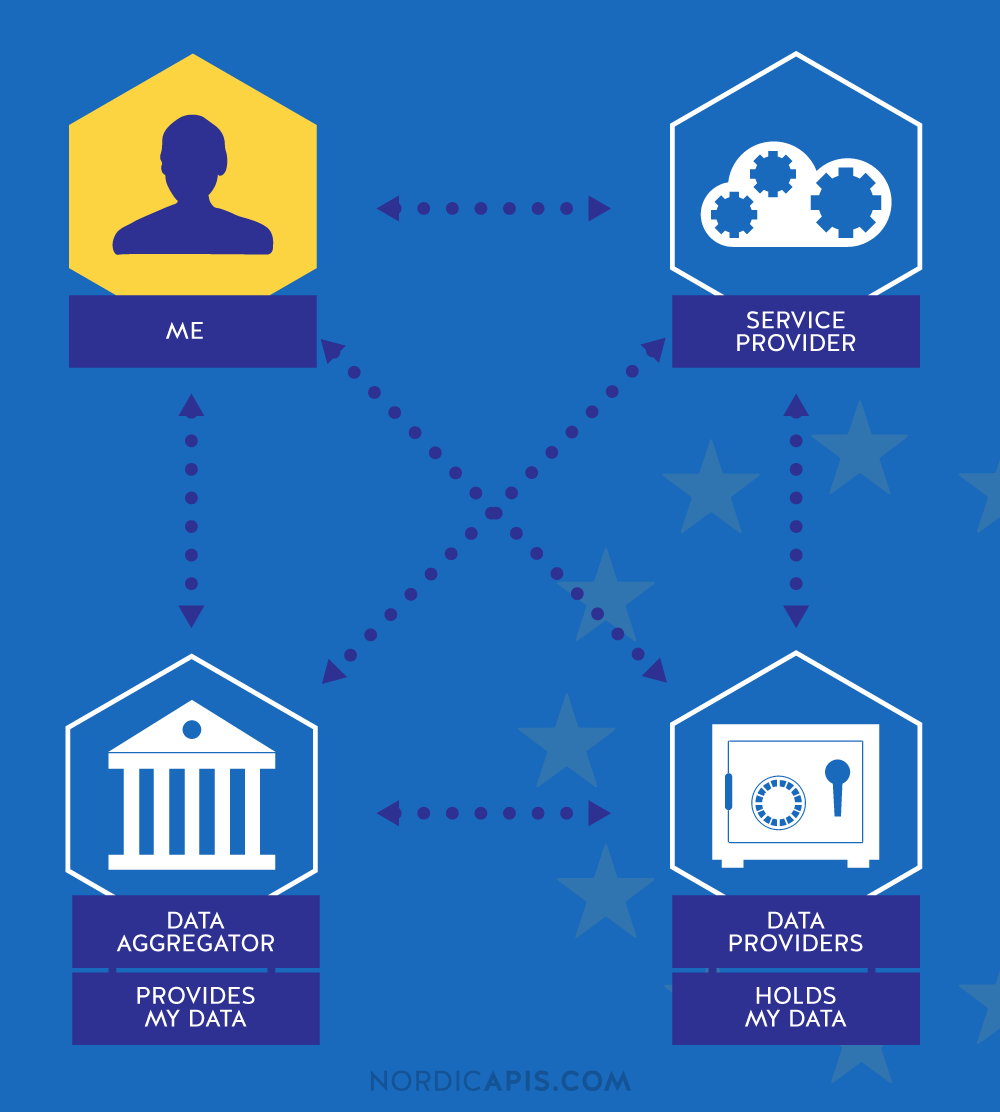

What is PSD2? In this context, PSD2 is an exciting new regulation which will allow small- to medium- sized enterprises (SMEs) to share their banking/financial information automatically with third parties in an electronic manner. Does not make such sense or sound exciting?

Let me walk you through a simple vision. You are an SME owner; you are tired of complaining about how much you pay in fees and interest; you get frustrated when you don't have easy answers to working with payments internationally.

Now here comes a PSD2-enabled startup. You go to their website and sign up, you give your consent that they can analyse your bank statements and banking details. This startup automatically retrieves all your bank statements without you having to do anything more.

Now starts the cool part: using modern big data analytics to determine your needs are and where you could cut down on costs.

These machine learning tools will analyse all your bank statements, check all your payments, and provide you with instant results, such as...

- You made a payment to Brazil and it cost you x% while if you had used this party it would have saved 50%

- You have insurance payments for cars, housing, etc costing X, if you combined them into one it would cost Y.

- Your business in Brazil is growing time to start getting a better provider for payments.

- You're paying freelancers in Spain, make this process using this local Spanish payment provider.

- Your loans are fragmented , and you are using them longer than you should we need to change some fixed to variable and change some short term loans to long term .

- Yours French customers provide 20% more profitability than your Dutch ones, the reason looks like your high Netherlands freight costs.

These systems will keep learning and providing better results and advice on all part of your business.

Small to medium size business owners and managers just don't have the time to spend on these issues when they are focused on the bigger picture -- keeping customers happy and keeping the business running.

Analytical fintech startups will use the huge data being generated by PSD2 to provide decision support on routine tasks.

Articles for further reading

PSD2: Disrupting Payments in Europe

Third party access to accounts (XS2A), the use of APIs to connect merchant and the bank directly and the ability to consolidate account information in 1 portal will undoubtedly disrupt payment services in Europe. Innovative companies will be eager to occupy this space and respond to consumer frustrations with existing incumbent providers. The challenge though, will be how consumers respond to new technology based providers and how these newcomers are able to meet the expectations of both the consumers and the European regulatory bodies. At the same time the newcomers must ensure the highest levels of security are implemented – after all they will potentially be handling YOUR payments and have access to YOUR account.

http://www.sepaforcorporates.com/single-euro-payments-area/5-things-need...

PSD2 Sanctions Access to Personal Banking Data, Amplifying FinTech Growth

Most banks lock customer data away in internal systems with very limited access, restricted to tightly controlled channels. This state of banking data accessibility is widely viewed by industry commentators and even banks themselves as nothing short of a travesty, epitomizing the hegemony banking giants have held for a long period of time.

nordicapis.com: PSD2 Sanctions Access to Personal Banking Data, Amplyfying Fintech Growth

Page content

About the author

Disclaimer

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from B2B Trade Payment Services AB or its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.