In this article, we will show you, step by step, how to make SEPA (Single Euro Payments Area) bank transfers.

What is a SEPA bank transfer?

SEPA bank transfer is a transfer done between banks of the 35 member countries of the SEPA system (that includes all EU member countries and other European states). Because the agreements regulate the fees paid for transfers, all of the transfers done in the Euro currency are subject to charge equivalent to that you’d normally pay for a domestic transfer.

If you want to read about SEPA, we invite you to check this article on SEPA countries and this one explaining the difference between SWIFT and SEPA.

How does SEPA bank transfer work?

When doing a SEPA payment, partnering banks from the SEPA zone are able to clear an amount of money in Euro from a bank account in Euro, provided by one of the banks in the member countries, for no additional fee than the one it would charge you to make a domestic transfer.

How long does SEPA transfer take?

In some cases, the transfer will be done instantly and visible on your recipient's account just a few minutes later. In other, it can take up to one business day. Get a SEPA instant account with our Partner Narvi Pay.

How to make SEPA payments/ How do I make a SEPA transfer?

To make payments in SEPA, all you need is the IBAN number of the person or company you want to pay. Most of the time if you enter IBAN, the system will auto-populate the BIC field (which indicates the bank further). An example of a B2B Pay IBAN transfer would be

Name: Sample or Company GmBH

IBAN: GB32TCCL0099XXXXXXXXX

BIC:

IBAN is a bank account format for accounts in the SEPA member countries, which start with any of the prefixes indicating the country in which the account is based.

Euro Zone countries: FI, PT, BE, AT,ES,CY,EE,FI,FR,DE,GR,IE,IT,LV,LT,LU,PT,MT,MC,NL,MT,MC,NL,PT,SM,SK,SI,ES

There are also non-eurozone countries that participate in SEPA: BG,CZ,DK,GI,HU,IS,LI,NO,PL,RO,SE,CH,GB

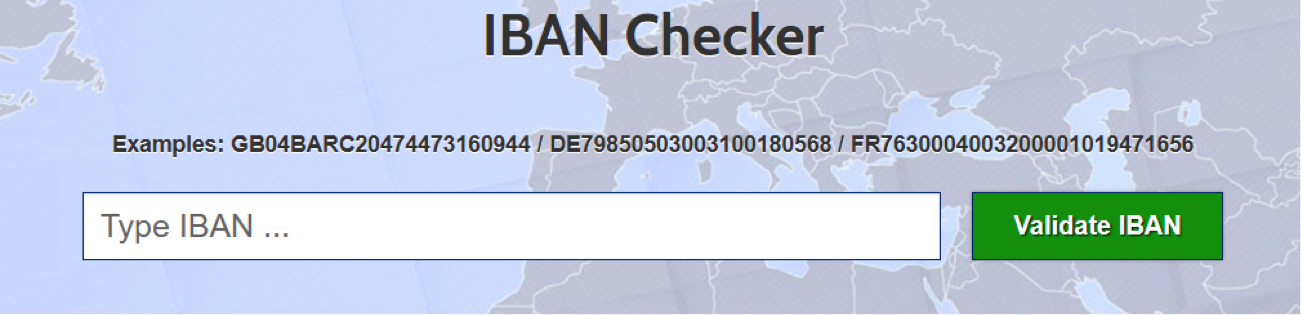

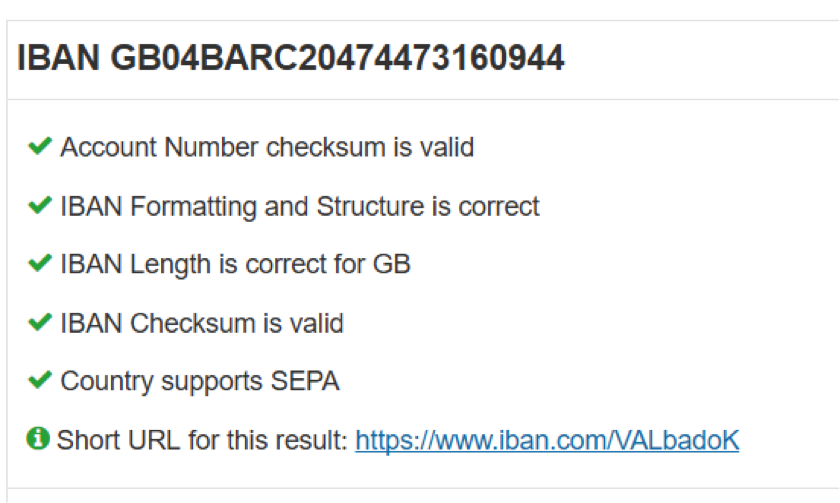

An easy way to check if an IBAN you intend to use is SEPA enabled is to use the website IBAN.com. Enter the IBAN and click Validate IBAN (the website will also notify you if the bank account is invalid).

Results

Results

To make the payment:

There are over 1000 banks in Europe, which means that the experience will vary depending on the platform and the interface they provide. There are two main bank types:

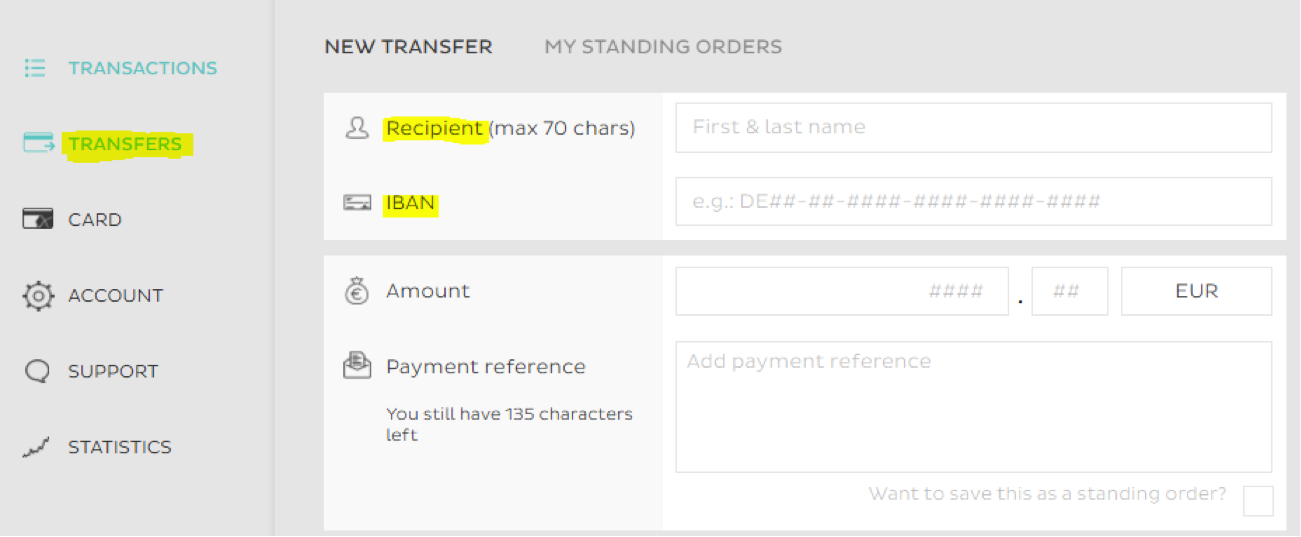

1) Modern: Enter IBAN/customer name and pay. New banks like B2B Pay, N26 or Fidor make SEPA transfers very easy, without taking you to multiple screens. European banks do not differentiate between accounts in other SEPA countries - all payments within the zone are treated equally.

In the picture below, you can see a sample transfer. You need to click on transfers, then enter the recipient's name and IBAN number, together with the amount you want to transfer and (often optionally) a payment reference. Now you can hit the pay button. Please check if your bank does not require an additional authorization of such payments. Below is an example from N26.com.

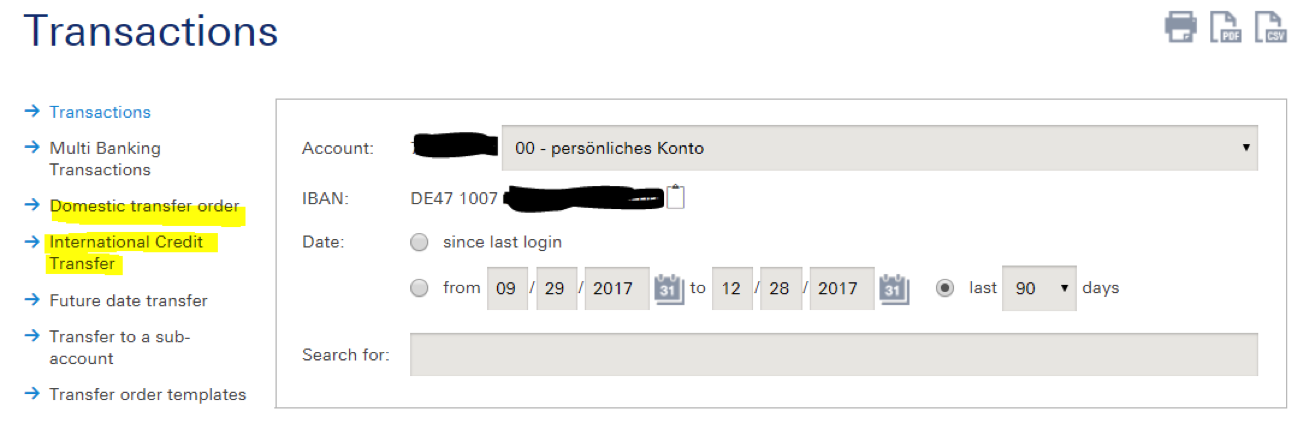

2) Complex old banking systems Some of the more old-fashioned banks use two screens, one for domestic payments, another for international payments, including SEPA. In this case, for transactions happening within the same country, customers use the Domestic transfer screen. But for SEPA transfers to another country (say, from Germany to Italy), they will be directed to the international screen. Below is an example from a Deutsche Bank customer: If you are making SEPA transfers to a German customer then you need to select domestic transfer order. If the payment is to other SEPA countries like France or Great Britain, then you need to select International Credit transfers.

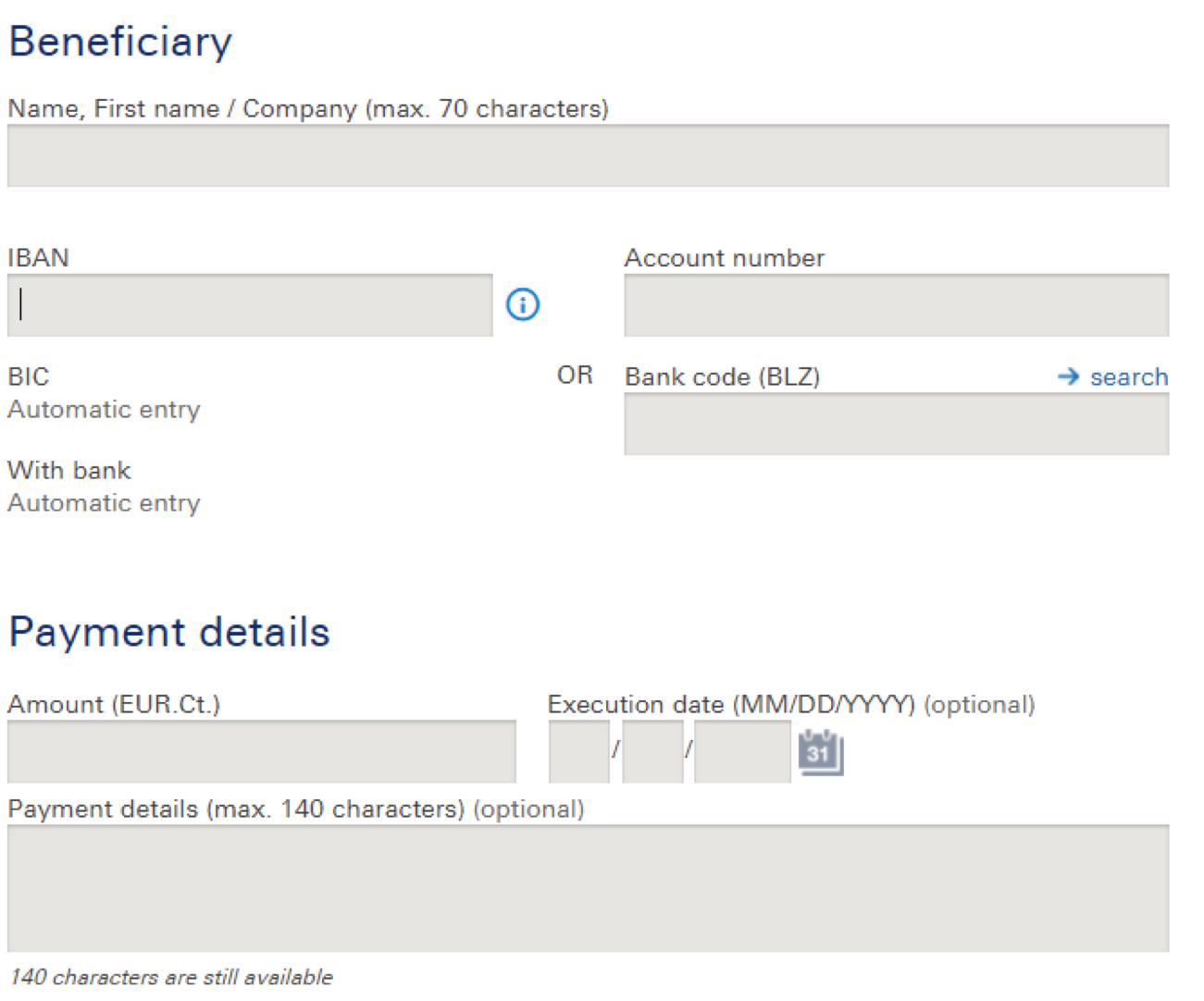

a) For Domestic transfers Enter the name/IBAN, the amount you want to transfer and reference before hitting send.

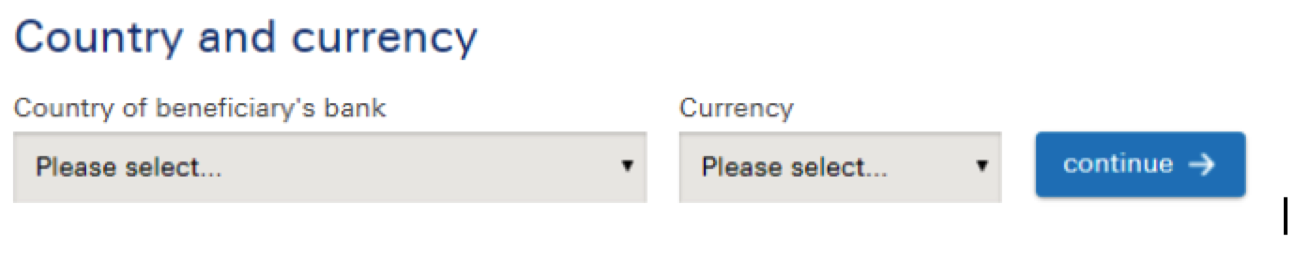

b) For international SEPA transfers. First, you need to select the country to which the payment is sent and the currency.

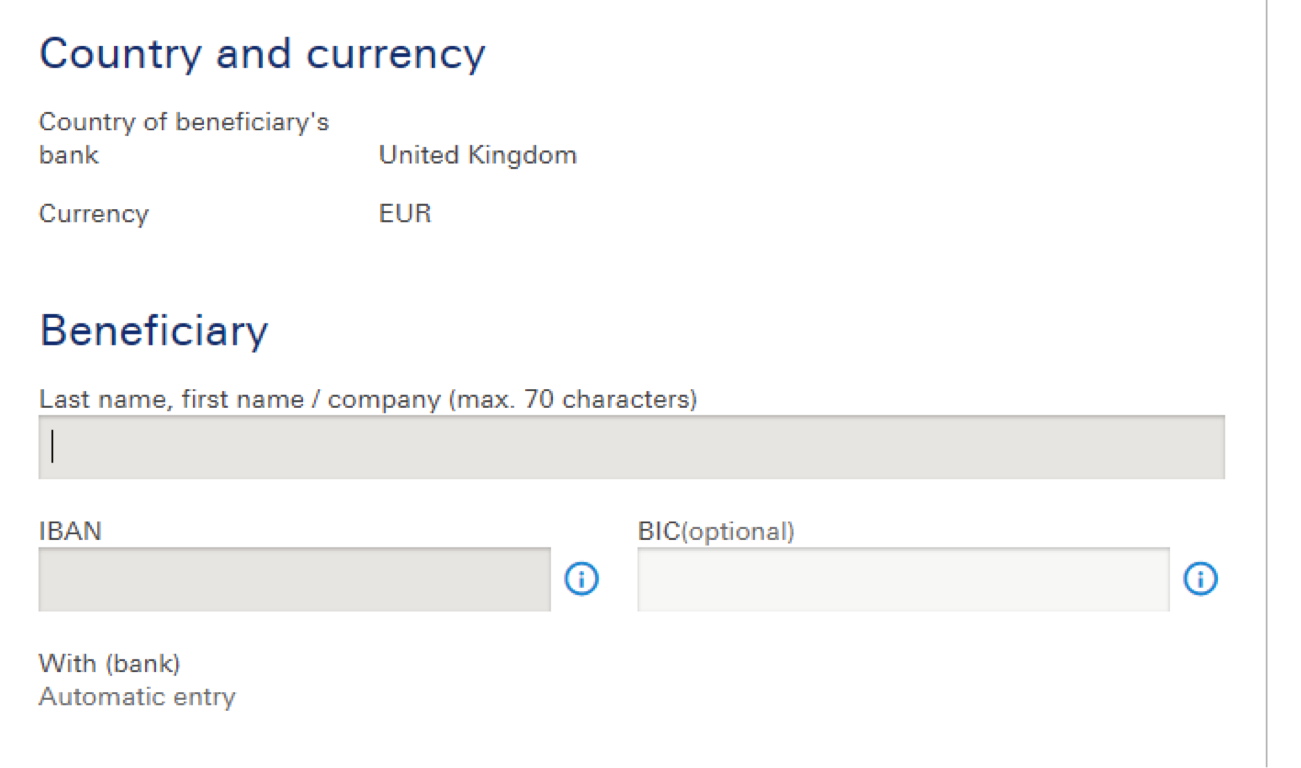

Once you have done that, the system will automatically check if it's a SEPA transfer or not. For example, if you select EURO and Great Britain, it will recognize it as a SEPA payment. If you select EURO and the United States as the country of the beneficiary, then it cannot be recognized as a SEPA payment and will be redirected to SWIFT payments. If everything is correct, you will see the following screen, where you enter the Customer name and IBAN, as well as the amount and the reference. You’re ready to hit send now.

Once you have done that, the system will automatically check if it's a SEPA transfer or not. For example, if you select EURO and Great Britain, it will recognize it as a SEPA payment. If you select EURO and the United States as the country of the beneficiary, then it cannot be recognized as a SEPA payment and will be redirected to SWIFT payments. If everything is correct, you will see the following screen, where you enter the Customer name and IBAN, as well as the amount and the reference. You’re ready to hit send now.

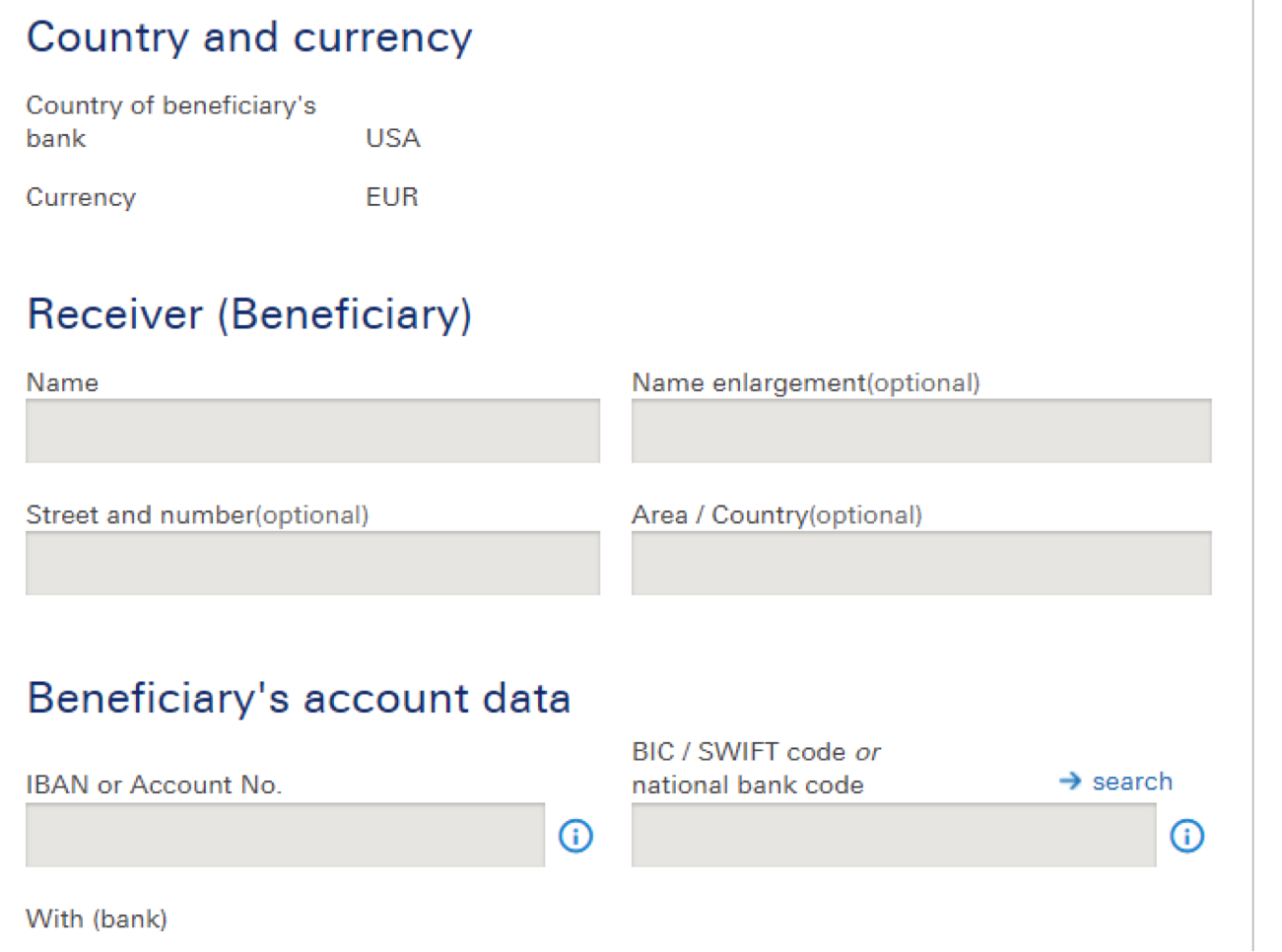

Below, you see an example of how a SWIFT transfer look like. The main difference here is that you will be asked to fill in some additional information before being able to transfer the funds.

About the author

Disclaimer

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from B2B Trade Payment Services AB or its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.