How to open a bank account in Lithuania

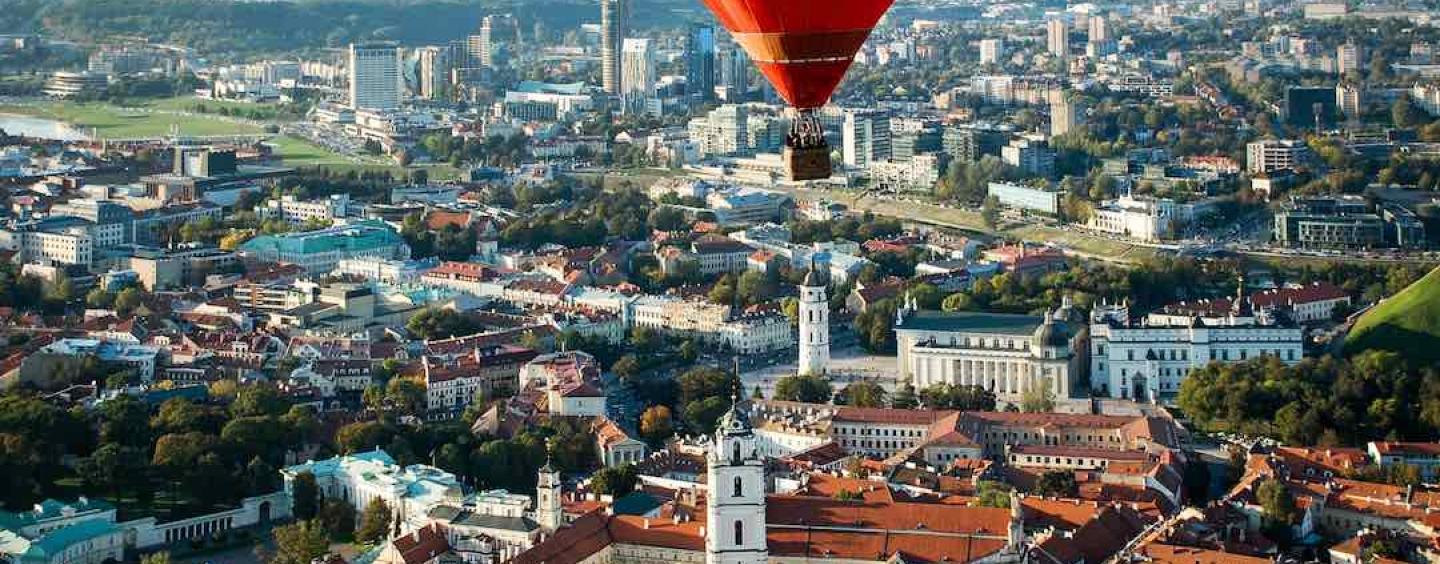

Lithuania is a small country with friendly hard working people and a rich cultural heritage. Being a relatively young nation of young people, it attracts workers and students from all over the world despite is small size. Vilnius is exciting, has beautiful architecture and a strong tech scene.

If you want to move to Lithuania or have already landed within its borders, opening a bank account is an important step to take. Here is our guide on how to open a bank account in Lithuania. MisterTango is probably the simplest way to open a bank account in Lithuania, and it comes with a free MasterCard. It's open to anyone who lives in the EU and they also have corporate accounts.

Documents to open a bank account in Lithuania

You will be required a series of documents when opening a bank account in Slovenia and the process should be straightforward:

- ID or passport (EU identity card works too)

- A residence permit (temporary or permanent)

You may be required to fill out a questionnaire which will include questions personal questions. For example, you will be asked to present information on why you need a bank account in the country.

Can you open a bank account in Lithuania as a non-resident?

>

Best are very cautious with non-resident bank accounts, but it is possible to open a bank account as a non-resident in Lithuania. You will be required to provide identification and other documents but if you do so it should be no problem. Check each bank's website (all available in English) for their requirements.

Best banks in Lithuania

There are various banks in Lithuania with at least a few dozen options to choose from between national and international banks. Most offer enough products to fit the needs of most with some specializing in retail, other in SMEs and other in investments and corporations. All deposits in Lithuania are protected up to 100 thousand euros and there will be account activation fees.

Here are four of the major banks in Lithuania that you can easily get informed in English and will be able to serve all your needs as a non-resident.

- Swedbank: with a selection of branches and ATMs across the country, Swedbank could be a convenient option for you. They have accounts with low monthly fees, debit cards and even credit cards (which will require additional documentation). You can keep your money in multiple currencies and they have English online banking and phone service.

- S|E|B: with a low cost bank account offer for non-residents of only 10 euros a month, SEB has great offers in their account for non-residents. With their accounts you can hold money in multiple currencies, pay bills and perform transfer via online banking and also receive your salary automatically. Their have a good ATM and branch network.

- DNB: With English service lines and banking agents as well as a full service online banking app, DNB can be a great choice if it is conveniently located and within your budget. They have a full range of services and products from current and savings accounts to simple mortgages. Debit cards are part of the standard account packages starting at only 1 euro per month.

- Nordea: this is considered one of the safest banks in the world with a long history in the nordic nations and a strong presence in Lithuania. They have accounts for foreigners with an English online banking app available, low monthly fee of .70 cents and debit card is included in the basic account. Their ATM & branch network is large.

It will be relatively easy to open a bank account in Lithuania as a non-resident. You will find English speaking staff and English websites available with information on most bank account types including business accounts. Services will be various as you can expect from modern nations and Lithuania is no exception.

You will be faced with fees if you bank outside of your bank ATM network so it is a good idea to be aware of all your bank's fees. Ask for a list of fees when you visit a branch. These will also be available online but it is easier to simply ask at a branch.

The virtual bank account alternative for businesses: Meet Narvi

It is expensive to send money outside of Lithuania

If you're a business regularly sending or receiving money across borders, using a traditional Lithuanian bank can get expensive fast — especially when it comes to currency conversions, SWIFT fees, and unpredictable settlement times.

Narvi offers a smarter solution built exclusively for global-minded businesses.

With Narvi, your company gets:

✅ A European IBAN to send and receive funds in EUR — fully SEPA and SEPA Instant enabled

✅ Access to multi-currency accounts supporting over 30+ currencies

✅ Real-time FX quotes and competitive exchange rates — no hidden spreads

✅ Transparent pricing: low flat fees, no SWIFT surprises

✅ Same-day or next-day settlement to 180+ countries via local rails or SWIFT

✅ A platform designed for financial controllers, CFOs, and export-driven SMEs

Whether you're receiving payments from European buyers or paying global suppliers, Narvi helps reduce costs, speed up settlements, and eliminate the headaches of traditional banking.

Page content

About the author

Disclaimer

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from B2B Trade Payment Services AB or its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

How to open a bank account in Europe

We have comprehensive guides on opening bank accounts across multiple European countries. These resources also explain how a virtual bank account with Narvi Payments can be a smarter alternative for international transfers, offering better exchange rates and greater convenience.

-

How to open a bank account in Andorra

How to open a bank account in Andorra -

How to open a bank account in Austria

How to open a bank account in Austria -

How to open a bank account in Bulgaria

How to open a bank account in Bulgaria -

How to open a bank account in Croatia

How to open a bank account in Croatia -

How to open a bank account in Czech Republic

How to open a bank account in Czech Republic -

How to open a bank account in Cyprus

How to open a bank account in Cyprus -

How to open a bank account in Denmark

How to open a bank account in Denmark -

How to open a bank account in Estonia

How to open a bank account in Estonia -

How to open a bank account in Finland

How to open a bank account in Finland -

How to open a bank account in France

How to open a bank account in France -

How to open a bank account in Germany

How to open a bank account in Germany -

How to open a bank account in Greece

How to open a bank account in Greece -

How to open a bank account in Hungary

How to open a bank account in Hungary -

How to open a bank account in Ireland

How to open a bank account in Ireland -

How to open a bank account in Italy

How to open a bank account in Italy -

How to open a bank account in Latvia

How to open a bank account in Latvia -

How to open a bank account in Liechtenstein

How to open a bank account in Liechtenstein

-

How to open a bank account in Lithuania

How to open a bank account in Lithuania -

How to open a bank account in Luxembourg

How to open a bank account in Luxembourg -

How to open a bank account in Malta

How to open a bank account in Malta -

How to open a bank account in Monaco

How to open a bank account in Monaco -

How to open a bank account in the Netherlands

How to open a bank account in the Netherlands -

How to open a bank account in Norway

How to open a bank account in Norway -

How to open a bank account in Poland

How to open a bank account in Poland -

How to open a bank account in Portugal

How to open a bank account in Portugal -

How to open a bank account in Romania

How to open a bank account in Romania -

How to open a bank account in San Marino

How to open a bank account in San Marino -

How to open a bank account in Slovakia

How to open a bank account in Slovakia -

How to open a bank account in Slovenia

How to open a bank account in Slovenia -

How to open a bank account in Spain

How to open a bank account in Spain -

How to open a bank account in Sweden

How to open a bank account in Sweden -

How to open a bank account in Switzerland

How to open a bank account in Switzerland -

How to open a bank account in the UK

How to open a bank account in the UK